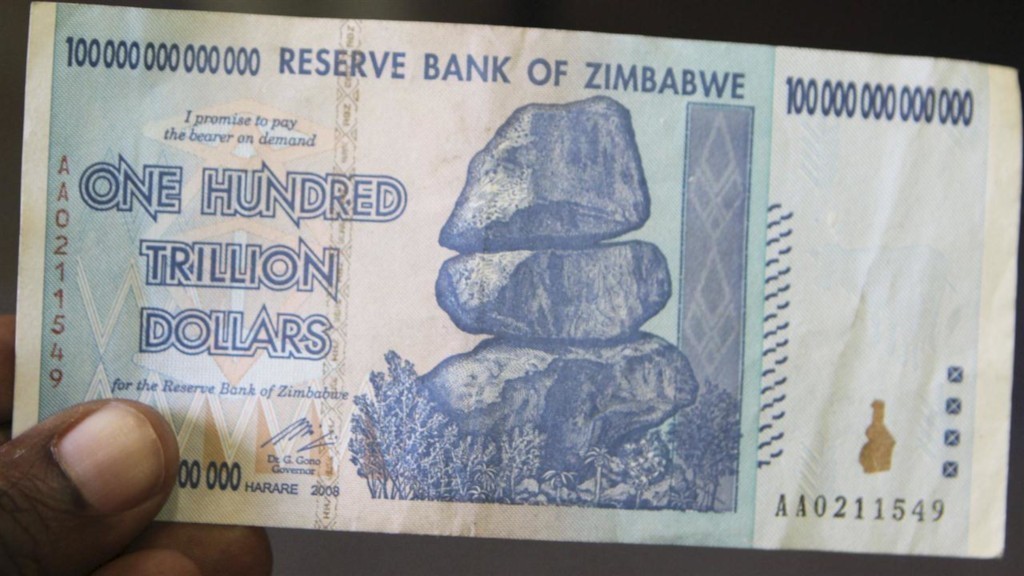

The Zimbabwean government is itching to introduce yet another currency. Their propaganda machine is working full throttle to convince the populace that this will be a good thing. We have maintained that such a move is unlikely to solve Zimbabwe’s economic woes.

The latest publicity stunt has been to claim that the new currency will the strongest currency in the region. What does that even mean? Does it matter? Will that solve our current economic woes?

WATCH: New Zim currency to be strongest in the region: https://t.co/6YylefCrds pic.twitter.com/RLOXd9V7Og

— ZBC News Online (@ZBCNewsonline) June 11, 2019

First things first

We need to define what currency strength is. According to Wikipedia

Currency strength expresses the value of currency. For economists, it is often calculated as purchasing power, while for financial traders, it can be described as an indicator, reflecting many factors related to the currency; for example, fundamental data, overall economic performance or interest rates. It can also be calculated from currency in relation to other currencies, usually using a pre-defined currency basket. A typical example of this method is the U.S. Dollar Index.

The easiest way to show a currency’s strength is to use exchange rates against the dollar. When we do this a funny picture starts to image. We already have one of the strongest currencies in the region.

The Bond Note (RTGS$) is already one of the strongest currencies in the region.

In the SADC region, the only currencies I know that are stronger than the RTGS$ against the USD are rupees from Seychelles and Mauritius. When our currency was introduced back in February we probably had the strongest currency in SADC too. Things have been going downhill before, during and after that anyway.

Conclusion

Having the strongest currency means nothing if other economic fundamentals are being violated. Zimbabwe continues to be at the bottom of corruption and business indexes. Currency strength means nothing when that currency is not stable.