ZIMSEC O Level Principles of Accounting: Single entry and Incomplete records: Introduction

- It is not at all uncommon for business owners to have incomplete accounting records

- A lot of SMEs (small and medium enterprises) often do not keep double entry accounting systems

- Consider the example of a banana vendor it would be ridiculous for him to keep a double entry system

- In such cases this is because the transactions involved and the size of the business do not really require such as a system

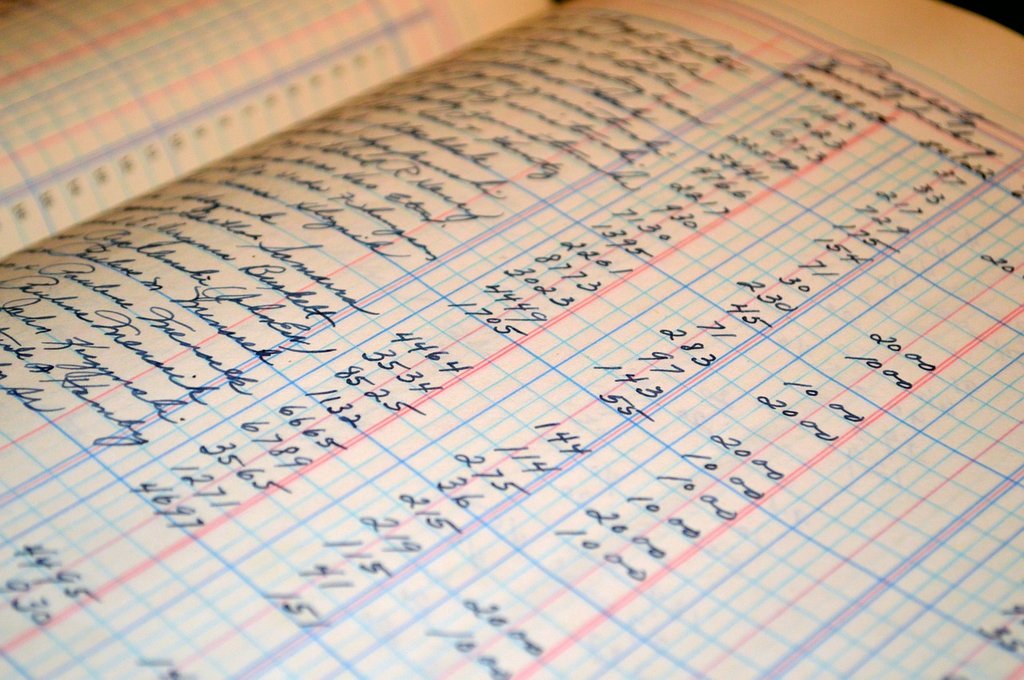

- Often such a vendor would have a book where they write down their transactions so as not to forget

- These transactions are often in single entry format

- Sometimes the lack of proper accounting records can be due to the fact that the proprietors lack accounting training

- Most of these entities are not really required to prepare financial statements

- At some point however these entities might find the need to prepare financial statements

- For example when applying for loan with a bank the entity might be required to submit its proper financial statements

- Sometimes records might be destroyed in a fire or other “act of God”

- In such cases accountants have to create financial statements using incomplete records

- Indeed during Auditing exercises incomplete record techniques are often used to authenticate the books

- The thing is for a number of reasons it is important for an accounting student to learn how to:

- Calculate Profit and

- Prepare Financial Statements

- Now while the techniques employed in doing these vary in the real life in examinations the following stages are required to prepare financial statements from incomplete and single entry records:

- Prepare a Statement of Affairs

- Create a bank and cash account summary for the period showing opening and closing balances

- Calculate Purchases and Sales figures for the period

- Determine expenses and other income for the period

- Draw up the financial statements using this data

- We will examine each step in detail

To access more topics go to the Principles of Accounting Notes.