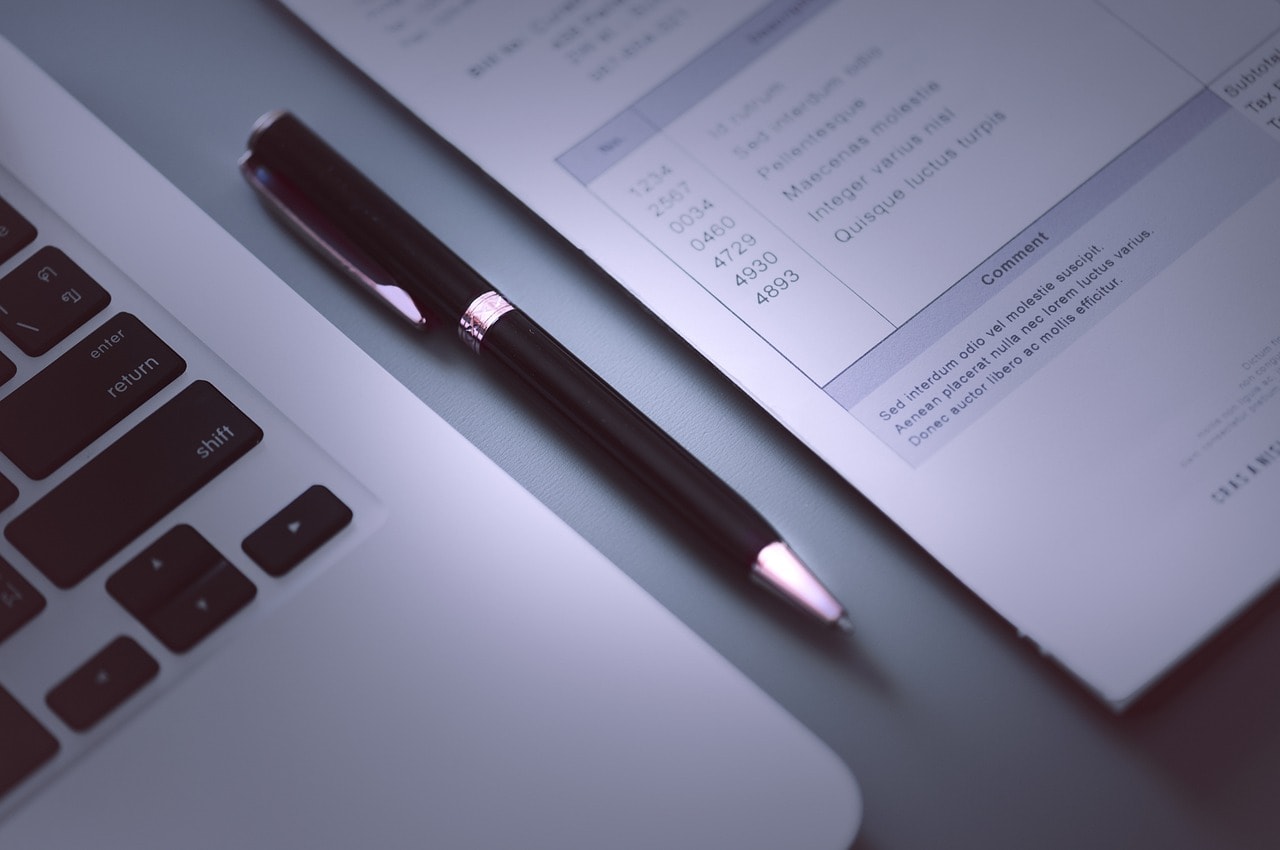

Absorption of Overheads: Overhead Analysis Sheet Example

Cambrige AS and A Level Accounting Notes (9706)/ ZIMSEC Advanced Accounting Level Notes: Absorption of Overheads: Overhead Analysis Sheet Example

- In this example we will look at how you can use an overhead analysis sheet to allocate and apportion overhead costs

- It is important to note that while the format shown below is the most popular

- It is entirely […]